Instant Payments Maven™

Keynote Speaker on Payments Modernization, Risk, and the Future of Money Movement

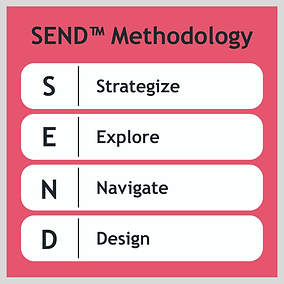

This page describes how FinTech Consulting supports financial institutions through SAFE™ to SEND™ advisory, applying the risk first framework in a way that aligns with each institution’s strategy, risk posture, and operating model. SAFE™ to SEND™ Advisory applies the SAFE™ to SEND™ framework to help financial institutions enable instant payments send with a risk-first, governance-driven approach.

SAFE to SEND™: De-Risked, Revenue-Ready in 8 Weeks

Most financial institutions are live on RTP or FedNow, but stuck in a receive-only rut.

SAFE™ to SEND™ Advisory is how you break out.

SAFE™ to SEND™ Advisory is a fixed-duration, expert-led accelerator that helps financial institutions de-risk and monetize Send-side instant payments.

In just 8 weeks, we help you:

-

Identify low-risk, high-value use cases

-

Build a board-ready business case

-

Chart a phased, practical launch path

Led by Marcia Klingensmith, the Instant Payments Maven™, SAFE™ to SEND™ Advisory gives you the clarity, structure, and confidence to move forward with risk, readiness, and revenue working in your favor.

Why Financial Institutions Choose

SAFE to SEND™

The Risk-Managed Instant Payments Accelerator for Banks & Credit Unions

-

Fast. Get clarity, alignment, and executive-ready outputs in 8 weeks - not quarters.

-

De-Risked. Every use case is vetted through the SAFE™ framework to minimize fraud, compliance, and operational exposure.

-

Monetizable. We prioritize use cases with real revenue potential, not just technical feasibility.

-

Board-Ready. Walk away with a concise business case, phased roadmap, and next steps that secure buy-in.

-

Tailored. Recommendations align to your tech stack, customer segments, and operational realities.

-

Credible. Led by the Instant Payments Maven™ — a former RTP® product executive with $13.8M+ in launch wins across banks and fintechs.

What you walk away with

-

Strategic Intent Memo: Aligns leadership on Send goals, risk appetite, and vision of success.

-

Maturity & Risk Heatmaps: Clear picture of current capabilities, gaps, and SAFE™ risk profile, with mitigation options.

-

Use Case Portfolio: Prioritized Send opportunities with risk/ROI scoring and feasibility overlays.

-

Mini Business Cases: One-page economic models showing revenue potential, costs, and quick-win sizing.

-

Feasibility & Partner Map: Highlights tech stack gaps, API/vendor dependencies, and where partner support is needed.

-

High-Level Roadmap: A phased, board-ready view of next-step decisions, not a full implementation plan.

These advisory deliverables are grounded in the principles of the SAFE™ to SEND™ framework, ensuring decisions around instant payments send are aligned with enterprise risk, operations, and strategy.

Example Use Cases We Help You Explore

-

Instant Payroll for Gig/SMB Clients

-

Real-Time Loan Disbursements

-

Wallet Funding & Digital Payouts

-

Interbank & Fintech Settlements

-

Request for Pay (Consumer + B2B Billers)

Who It's For

If your financial institution is live on RTP or FedNow, but still stuck in receive-only mode — SAFE™ to SEND™ Advisory is for you.

It’s ideal for senior leaders and cross-functional teams in product, operations, risk, treasury, payments strategy, or innovation who need a clear, de-risked, and credible path to monetize Send-side instant payments and gain executive buy-in.