Struggling to move beyond receive-only?

Let’s fix that. Book a consult or explore my YouTube series, Instant Payments Decoded.

Home of the Instant Payments Maven™

Helping Financial Institutions Monetize Faster

SAFE to SEND™: Stablecoin Edition

From GENIUS to Global — Stablecoins Made Safe, Simple, and Strategic.

The rules of the game have changed.

With the U.S. GENIUS Act reshaping the regulatory landscape for dollar-backed stablecoins, financial institutions face a new mandate: evaluate, enable, and govern stablecoin-based disbursements—or risk being outpaced by fintechs and global competitors.

Stablecoins are no longer experimental. They are becoming a regulated, programmable form of digital money that can power cross-border payments, treasury liquidity, and tokenized deposit innovation.

Institutions know the opportunity is real, but uncertainty keeps them on the sidelines:

-

How do stablecoins fit within existing payment rails like RTP® or FedNow℠?

-

What use cases are safe to explore now?

-

How can we ensure compliance and liquidity controls before we launch?

SAFE to SEND™ Framework

SAFE to SEND™: Stablecoin Edition provides an 8-week, vendor-agnostic path to clarity and action.

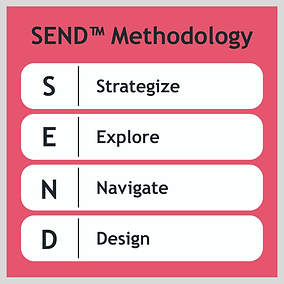

Built on FinTech Consulting’s proven SAFE™ framework — Settlement, Authentication, Fraud & Exposure, Economics — this program helps financial institutions de-risk stablecoin adoption and deliver a board-ready roadmapfor compliant, monetizable use cases.

-

Program Outcomes:

✅ Identify high-value, low-risk stablecoin use cases

✅ Align risk, treasury, compliance, and product stakeholders

✅ Benchmark readiness under the GENIUS and MiCA frameworks

✅ Build a phased launch plan for tokenized deposits and cross-border disbursements

Example Use Cases We Help You Explore

-

Cross-Border Payroll & Remittances: lower fees, 24/7 settlement, regulatory alignment

-

Treasury & ERP Integration: programmable disbursements, tokenized receivables

-

Government & NGO Disbursements: faster aid and emergency relief

-

Merchant Settlement & Pay-on-Delivery: liquidity optimization

-

Tokenized Deposits & On-Chain Liquidity Management: bridge to the future of programmable money

📅 Book a Complimentary Stablecoin Readiness Review

Benchmark your institution’s readiness, discuss potential use cases, and identify next steps toward a compliant, monetizable launch.

Where to find us:

+1 704 907 1249

Calendar Availability:

Stay Updated

Subscribe to Our Newsletter

Join Our Community

Name

Follow Us on Social Media

Join the Conversation